Let us start with what will be the biggest understatement of 2025: DeepSeek changed a lot!

In the ever-changing world of AI, it has been widely accepted that developing leading-edge large language models (LLMs) requires significant technical and financial resources that are within the purview of only a few. In 2025, it is anticipated that Alphabet, Amazon, Meta, and Microsoft will collectively spend US$320 billion on AI-related investment to build and cement their moats. Keeping up with the Joneses is supremely expensive, but getting the strategy wrong or falling behind could present an existential crisis.

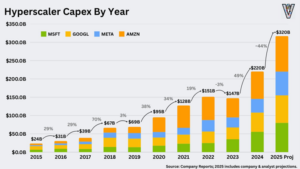

To put this expenditure in perspective, US$320 billion, or approximately 150% of New Zealand GDP, is a very big number indeed. As the chart below depicts, it will be US$100 billion more than the amount these companies spent on the same activity just last year.

Like the companies themselves, investors have run the ruler over the entire AI capex ecosystem and invested in the businesses operating in the end-to-end delivery of this technological revolution. As a result, company share prices have pierced record after record as earnings have accelerated alongside revenue and margins.

But what if China’s DeepSeek has re-written the consensus wisdom? And what happens if the pace of investment slows?

The news that DeepSeek’s R1 LLM was at least as good as the more established models from Alphabet, Meta, and Open AI, and trained at a fraction of the time and cost, rocked investment markets and may have firmly punctured the narrative that AI progress requires infinite spending. As the industry adjusts, the implications for investors may be profound, with a growing divide between consumer and enterprise use cases shaping the future.

On 27 January, the AI-related complex lost well over US$1 trillion in market capitalisation; Nvidia alone lost almost US$600 billion. But it was not just the obvious and well-known names that took punishment. The AI-related ecosystem is enormous and encompasses land, groundworks, air conditioning, power generation, servers, GPUs, and all the cabling that connects it.

Since that day there have been calls that DeepSeek’s claims were false, and OpenAI suggests it has evidence that DeepSeek used distillation techniques to train its model in a move that contradicts fair use. But regardless of the merits of these arguments, the model is open source and its method of learning transparent.

The subsequent recovery in share prices and the broader market softens the blow but it may also mask an undercurrent of change. Looking back there have been other examples of change that were flagged, though not necessarily overtly. The warm embrace of complacency and inaction fuelled by recovering prices can be punishing but may ultimately prove to be the correct strategy. However, the flags of change are waving, and it may be that DeepSeek is painting a new way of thinking and the numbers have changed order. Investors need to be on high alert.

Uniformly the industry circled the wagons and pounced on the Jevons Paradox: the notion that if a technological advance dramatically cuts the cost of some good or service then demand will spike and revenue will increase. The most common example cited is petrol and miles driven.

Where there is a pervasive use case, utilisation can see a dramatic response to lower prices, unleashing demand. However, for AI the anticipated explosion may not be imminent, especially in the enterprise setting.

Increasingly investors are looking at expected return on investment (ROI) of this extraordinary capital spend, and this lens appears to be identifying the early winners or at least making them the favourites. Meta announced US$60 billion to $65 billion and Alphabet US$75 billion, while Microsoft and Amazon will spend US$80 billion and US$100 billion respectively. While it is tempting to see the quantum as the reason for the differing share price reactions, it is almost certainly driven by expectations of better ROI driven by the nature of the investment.

Since ChatGPT burst onto the scene, peers have raced to catch up. Initially the difference in the LLM capabilities was marked; however, as each iteration has been brought to market, the differences have become smaller. While they are not yet fully commoditised, the creation of value will be to ensure that the training is targeted. For both Alphabet’s Google and Meta’s Llama, the specific training is aimed at improving the monetisation of their advertising strategy, which provides most of each company’s revenue.

ROI is also critical for future funding of the build-out. Debt investors will be feeling a little rattled given the amount of money at risk, and may be somewhat reticent to inject more money until the revenue opportunity emerges. However, perhaps the industry can take some faith in the actions of one of the investing greats. Masayoshi Son of SoftBank is reportedly set to invest US$40 billion in OpenAI at a valuation of US$340 billion.

Consumer vs. Enterprise Use Cases: A Growing Divide

With ROI in focus, investors are searching for the compelling use cases that will see mass adoption and accelerating revenue, justifying the sunk capex and averting the possibility we are heading for significant AI capacity oversupply.

DeepSeek’s breakthrough has amplified the divide between consumer and enterprise AI use cases, with consumer-facing applications currently in the driving seat. On the company’s recent conference call, Meta’s Mark Zuckerberg emphasised his belief that the consumer market is AI’s natural home and that 2025 will see the company’s personalised assistant reaching 1 billion users. With 3.35 billion daily active users across his application ecosystem, he may well be right.

Further confirmation of Zuckerberg’s view may also be seen in the apparent behaviour of OpenAI which, despite its enterprise roots, appears to be pivoting towards consumer through the rapid sign-up of paid GPT subscriptions. This is a hard road to travel, with consumer-facing business supported by advertising, and in this world the competitors are fierce.

Alphabet, through Google, is the other gorilla in the room and it is not sitting still; its aggressive build-out continues, with the emphasis in spend tilted towards better, targeted advertising. For OpenAI, competing against Alphabet and Meta means the road will be long and lonely, especially since its relationship with Microsoft is clearly frayed.

The changing tone at Microsoft may also be sowing the seeds of doubt. Certainly, it continues to spend a colossal amount of money, but in its October conference call a new phrase crept into the meticulously planned script. “Demand-based spending” was mentioned several times and may indicate the company is nearing the capacity it needs for now and can slow down. That may appear a long bow to draw, but in its most recent quarter the company rolled “fungibility” into their transcript.

The exact meaning of fungibility in this context is unknown, but it is quite possible it means the ongoing and future capex of Microsoft can be deployed more dynamically and may encompass different hardware types that are not the current focus of attention.

At its heart, Microsoft is a company focused on ROI, and it seems sensible to consider whether the company is shifting away from speculative capex given the slow demand picture at the enterprise.

Government

The US has long sought to dominate the technological revolution, and the export of advanced semiconductors has been controlled. This was highlighted at the recent AI summit in Paris, where there was a clear shift in the dynamics to a more geopolitical competition. The race for AI supremacy is on, and the Trump administration also announced Stargate, a US$500 billion programme to unlock the future of AI.

In addition, the administration has set its sights on removing regulations, especially on those which stifle innovation and the ability to progress at pace. While it may not be a ‘win at all costs’ approach, it is clear that both the US and China are vying for the top spot, and that the refusal of the US and the United Kingdom to sign up to a collaborative communique that calls for “ensuring AI is open, inclusive, transparent, ethical, safe, secure and trustworthy, taking into account international frameworks for all” indicates the competition is real. AI is the new space race!

Implications for investors

It remains unclear whether the extraordinary levels of spending continue unabated indefinitely given the use case conundrum. Of course it will come, but the timing is uncertain, and much capacity has already been built or is being built in anticipation that it is nearing.

The numbers will remain eye-popping, but DeepSeek may have shown a new and cheaper way to General Intelligence. Perhaps Jensen Huang knows this, because at CES 2025 he spoke significantly on robotics. There is no doubt that better technology creates better and faster models, but it may be one of diminishing returns.

As with all game-changing technologies, it all comes down to a product cycle. Some are longer than others but as one cycle slows, another will accelerate. With technology one of the greatest enablers of productivity and prosperity, software may be one of the areas that benefits the most. Wrapping AI into the offering and at lower costs could dramatically increase efficiency and utilisation, thereby supercharging the sector.

In August last year I wrote, “The rate of growth is going to slow dramatically and at some point, there will be an industry reset. The real value for investors lies in deciding where and when that ‘some point’ is.”

What is clear: we are at the beginning of a revolution. We had a reset this January and although many of the companies have recovered, it seems the air is escaping the popular narrative. AI will change much of what we do and bring discovery and invention – at breakneck speed – that have hitherto been the realm of science fiction. The way we work and how we discover and imagine will evolve at an accelerating, universe-exploring pace, just as Buzz Lightyear might have imagined.

The race is on to be the leader and influencer, and the money is flowing like a tsunami, but the narrative has changed and the water will move with it. One should mark the signs.

The genie is out of the lamp, and it is going to be exciting!

Tim Chesterfield is the long-time CIO of the Perpetual Guardian Group and the founding CIO and Director of its investment management business, PG Investments. With $2.8 billion in funds under management and $8 billion in total assets under management, Perpetual Guardian Group is a leading financial services provider to New Zealanders.

Perpetual Guardian Group acquired boutique fund manager Castle Point in 2024, which now forms part of the Group’s investment management suite of businesses.

Disclaimer

Information provided in this publication is not personalised and does not take into account the particular financial situation, needs or goals of any person. Professional investment advice should be taken before making an investment. The information provided in this article is not a recommendation to buy, sell, or hold any of the companies mentioned. PG Investments is not responsible for, and expressly disclaims all liability for, damages of any kind arising out of use, reference to, or reliance on any information contained within this article, and no guarantee is given that the information provided in this article is correct, complete, and up to date.

This article was originally published by the NBR. You can read the original piece here.