This article was originally written and published by Openly Investing.

“Ride the horse in the direction that it’s going” – Werner Erhard

The title of this document suggests how asset prices are currently behaving depending on which asset class or investment you are looking at. There does appear to be a trend but to say it is one-directional would be inaccurate and I sense a change in the wind is coming, the question is, what is the trigger and when will it manifest itself. I would like to call the current environment a dichotomy conundrum where two variables seemingly at conflict are not but then are at the same time. Indeed, dichotomy is almost certainly the wrong word, as to suggest there are only two conflicting variables would be woefully short of reality.

However, what I can say with some certainty is that either interest rates will go up soon or they will not, that inflation will either be running hot for longer or it will not and that central banks will taper their economic stimulus more aggressively than many believe, or they will not. Clear so far? This is the dilemma, one minute it appears clear and the next not so, but it is the narrative facing investors and the decisions that need to be made in capital allocation.

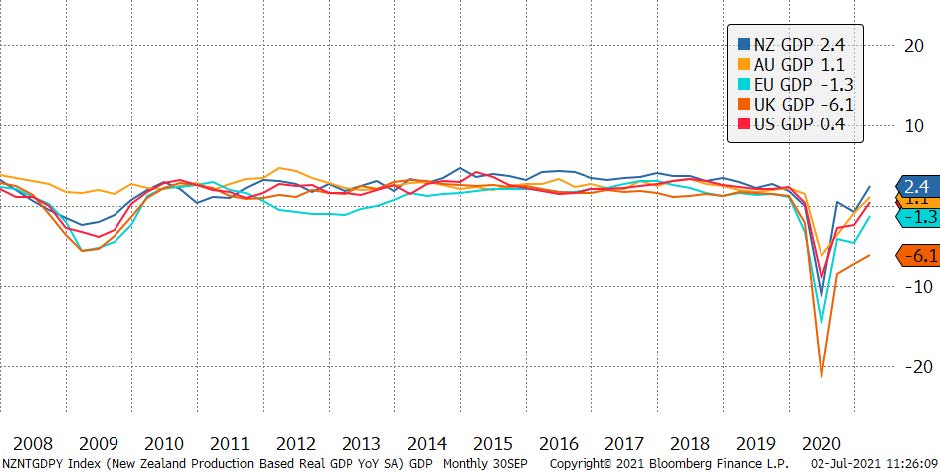

To varying degrees, economic growth is synchronised across the world and this is especially so in countries and regions where vaccination success can be seen. Even in those countries with lower vaccination rates or where countries remain at varying levels of lockdown to contain the viral spread, growth can still be seen when compared to the darker days of 2020. Indeed, what has caught economists by surprise is how significant the bounce back in growth has been, which is the result of pent-up consumer demand is often significant and steep.

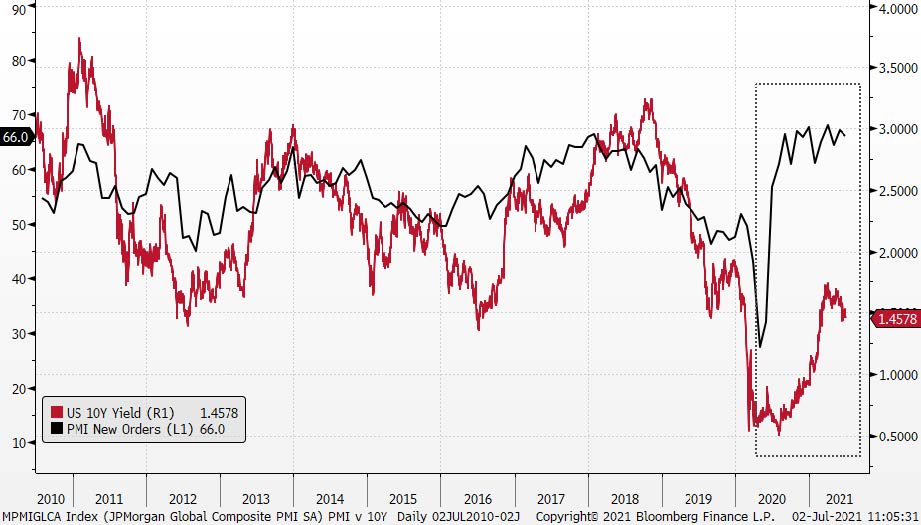

Internally we debate the environment daily and we monitor the situation and attempt to join the dots and having seen yields move higher, the result of interest rate expectations, we now find ourselves in what appears to be a trading range. This is where bonds can appear expensive (lower yields) and we would expect investors would sell to a level where yields offer compensation for interest rate risk and are better bought. Whilst this relationship holds, trading in bonds can be rewarding but what of the longer-term?

At Openly, our fixed income specialist has advocated being exposed in the middle of the curve or shorter duration than many may adopt. The premise for this is clear. Uncertainty over the longer term-inflation outlook, economic growth, data and the removal of stimulus – which are all interconnected or influential in their own right point to higher yields over time.

We all agree with this outlook, but the pace of the increase is a hotly debated issue. My current view is that US 10 Year bond yields will rise toward 2% over the next year and that this could even be by the end of this or even early next year. When one looks at the gap between bond yields and the current level of the PMIs (Purchasing Managers Index), based on any historical basis, it is too wide, and something needs to give. Now admittedly, this could be resolved by weakening PMIs, but it is unclear to me how this would meaningfully happen ex a resurgent virus and ensuing economic dislocation which, of course, cannot be ruled out entirely. What is not in question is the long-term relationship between PMIs and US 10 Year bond yields although I readily admit they can diverge for periods of time.

Recent economic data in this critical measure has continued to show increases in activity that points to additional upside surprises in other readings elsewhere and critically in demand and price related inflation. In the most recent showing, the PMIs in the US jumped to a level not seen for decades with activity, new orders, prices paid and backlogs all increasing sharply.

All of these components point to rising inflation and yet the rhetoric from central banks is that inflation will rise and then peak given the transitory nature of some of the inflationary components with the normalisation of the supply and demand imbalance resolving themselves over time. Of course, I agree with this notion given large percentage increases cannot continue forever but I struggle to believe that central banks are ahead of the curve. With a normalisation in economic activity we have, as a global economy, at least six to nine months of lost demand to cater to at the same time that supply bottlenecks exist.

Again, these will be resolved over time and do not necessarily portend runaway inflation or the need for draconian measures, such as high interest rates or onerous monetary policy, but it is the change in the expectation for any normalisation that is the potential fly in the proverbial ointment.

Currently, expectations for a rise in US interest rates sit in 2023 or more accurately two hikes by the end of 2023. This is hardly a scary forecast but what should be noted is that up until the announcement of this new expectation, the US Federal Reserve (FED) had resolutely stood by a 2024 estimate. What this change in sentiment recognises is that we are operating in a dynamic environment and that central banks are not wishing to be caught flat footed.

I would expect this change in sentiment to continue and whilst it never augers well to ‘bet against the Fed’ they will not be afraid to change stance where required. Indeed, recent statements by varying Fed officials portrays a non-linear view of the economic path and any requirement to tighten policy. With that said, after what almost appear to be unguarded comments, they are then quick to elaborate in a way that seems to ‘tow the party line’.

Confusingly, despite the tighter path to the next rise in interest rates, the US Fed has yet to indicate any change in its bond buying program, but I would expect this to come sooner than many believe. With that said, this can be ratcheted back and still provide a stimulative backdrop which is an indication of just how loose monetary conditions currently are.

Bond investors appear to believe the Fed is ahead of the curve which can be evidenced by the recent rally in bond prices leading to a flattening in the yield curve, but current policy and wage movements suggest this is far from certain. In addition, input costs such as oil and broader commodities linked to economic expansion continue to run at elevated levels and cannot be ignored.

I am not saying bond markets are wrong of course, far from it, but what I am wary of is the possibility that investors are paying too much attention to central bank rhetoric and their ‘jaw boning’ of the economic situation and inflation outlook, with the latter point implicit in the direction of interest rates and yields. With that said, I have repeatedly asserted that peak growth is now behind us especially as we begin to anniversary the worse effects of the pandemic economic dislocation. In addition, the rise in bond yields has already begun the process of economic tightening with higher borrowing costs a brake on growth but again, conditions are far from tight.

Another element that needs to be considered here is that of China which, after leading the recovery charge, has begun to slow down with social financing growth falling precipitously alongside real estate loan growth which are declining faster than overall loan growth rates. Not surprisingly, this is feeding into Chinese PMIs which show signs of weakening.

As indicated above, COVID is a fly in every ointment which makes conviction in economic calls rather difficult. The rise of the Delta variant – which is the dominant strain in the UK – is estimated to be 60% more transmissible as well as being more likely to cause hospitalisation but I would note that despite rising cases, that it is not necessarily leading to equally high hospitalisations. What is a concern is the rate of vaccination adoption in the US which has slowed dramatically with 45% of the population fully vaccinated and 13% or a whopping 43 million people potentially refusing to be vaccinated. With that said, the recent opening up in the UK of vaccination availability to 18 years and over has been met with unprecedented demand and bookings.

The good news here is that despite the rise of the Delta variant, the vaccines currently available remain effective and should see – ex a new variant – minimal ongoing disruption. This too may ultimately provide an avenue to increase international travel and with it the relaxing of worker related bottlenecks, but this is a long-term call, and we should not expect wonders anytime soon – notwithstanding people’s scepticism about other countries being safe or otherwise. But, as evidenced in the UK, the desire to holiday is ever present with spikes in bookings to countries most recently added to the green list. But it

is dynamic as can be evidenced by Portugal’s amber to green to amber round trip in a matter of weeks and the instability of the Trans-Tasman bubble between New Zealand and Australia.

Another pro economic phenomenon the pandemic has brought is a resurgence in personal savings with estimates that excess consumer saving is in excess of 11% of US GDP and may be even higher. That is a lot of money and if spent will see consumer demand to continue to rise.

I could go on and this goes to my opening point. The data is conflicting in many respects, but it is simultaneously not in other aspects. How is that possible? Certainly, bond investors are looking at the equation favourably but I suspect we are only another significant data point or two away before the rise in yields starts again. What will be key to watch is whether the aforementioned ‘range’ is adhered to.

Typically, these investment cycles test and re-test multiple times as conflicting views get resolved with each economic release, but they do get resolved and sometimes quickly. What does all of this mean elsewhere?

The gyrations in bond markets are also being mirrored in equity investments too after all, valuations justifiable by low interest rates are being put to the test. In addition, ‘risk’ assets do not like periods of uncertainty or slower growth and most certainly not runaway inflation. No, their favoured place is the one told by the story of goldilocks – not too hot, not too cold but just right!

To my mind, and as suggested above, I feel we are erring on the side of too hot, but it is simultaneously not searingly so and at this point in time, equity valuations are pretty meaningless when there is a wall of money that needs to find a home and a return. In addition, whilst peak growth in revisions is well behind us, earnings estimates continue to trend higher and besides, prices to free cash flow are far less extended. Overall, this remains supportive of equities, but I suspect their ultimate fate will be driven by the success or otherwise of the central banks’ ability to remove the excess liquidity with minimal disruption.

At the start of the year, I suggested that we could see returns in excess of 10% and at the time of writing that appears conservative in pretty much all markets excluding New Zealand.

Why New Zealand equities are down may appear a little conflicted given I believe the economic conditions here warrant the central bank tightening sooner rather than later. GDP is close to the same level as it was pre-pandemic and that is without the significant contribution from the tourist industry which amounted to approximately 6% of GDP. Currently, expectations for an increase in interest rates here point toward the first half of 2022 – with some possibility that it may be earlier and even in late 2021, but it not just the possible interest rate move that has cause New Zealand’s underperformance. The answer in the NZXs underperformance may lay in the concentration of the investments that comprise the index. Year to date, large companies that represent a significant percentage of the market capitalisation are down double digits. A2 Milk, Meridian Energy, Chorus, Fonterra, Contact Energy etc are all down between 10% and 45%, all of which represent a significant drag to investment returns.

With the majority of this note suggesting that interest rates may move faster than many believe, I concede that it may lead to additional caution on behalf of investors, but I find it a little difficult to be overly pessimistic given the supportive nature of policy and there may be further price increases in a ‘melt up’ over the remainder of the year, especially with a ‘risk on’ environment continuing to rule the roost.

Around the world, many measures of economic activity are near or at their pre-pandemic levels, yet we continue to see governments pass additional fiscal packages aimed at cementing the recovery alongside the loose central bank policy. In the US there have been infrastructure bills passed with additional stimulus murmured and there is in excess of $2 trillion (yes trillion) in excess savings. This coupled with rising wealth through house prices and investment assets could lead to further heady consumption down the road, propelling company profits and share prices as well as inflation be it transitory or not. As a result, risk assets should continue to be well supported.

Turning back to the inflation merry-go-around, moderate to rising inflation is also good for equity investments, after all rising inflation is rising prices and rising prices is rising profitability. Here the rule of thumb is that when the 10 Year breakeven inflation rate remains below 3% it is a good thing, but when higher it becomes an impediment to equity prices as they begin to de-rate and share prices decline.

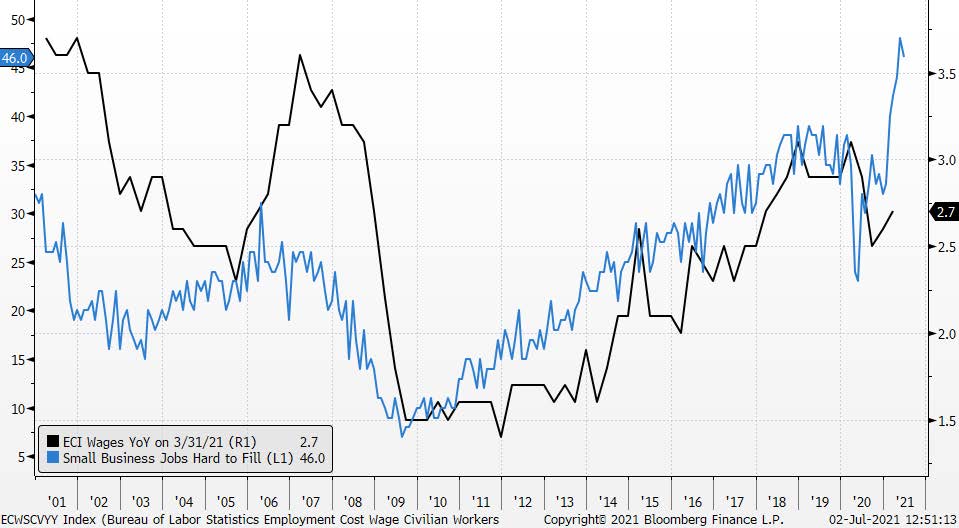

Wage inflation is the key here. After years and years of wage deflation, the big question is whether we will see the opposite and real wages rising at a faster pace. This is possible with shortages in labour, but it is by no means a given and without wage inflation, other inflations may still be transitory – albeit for a long time. Indeed, real wages have been rising for quite some time but at a moderate pace as would normally be expected.

It really is a confusing time and left of field events can humble everyone through asset price reactions that seemed unlikely only days before. Remember, investments do not know who we are, nor do they care who we are. They do not feel remorse for going down or euphoria for going up. They are a function of collective (or otherwise) wisdom and economic fortunes.

For the moment I remain positively predisposed to risk assets and range bound fixed interest securities, but we will keep our ears to the ground with the aim of – hopefully – anticipating the next move and its size. One thing we will not be doing is riding the horse facing the wrong way!

Tim Chesterfield

Chief Investment Officer

Openly Investing Limited.

July 2021

DISCLAIMER

This document is provided for general information purposes only. The information is given in good faith and has been prepared from published information and other sources believed to be reliable, accurate and complete at the time of preparation, but its accuracy and completeness is not guaranteed. Information and any analysis, opinions or views contained herein reflect a judgement at the date of publication and are subject to change without notice. To the extent that any such information, analysis, opinions or views constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised advice under the Financial Advisers Act 2008, nor do they constitute advice of a legal, tax, accounting or other nature to any persons. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this policy or its contents.

18 March | COVID-19 & Global Economy Update #3

The COVID-19 pandemic continues to impact the global economy more significantly than anyone had first expected. Read the 3rd update on global markets from Openly Investing here.

12 March | Crude Oil & COVID-19 Update #2

Crude Oil Continues To Be Impacted By Covid-19 As The Pandemic Continues. Read The Second Update From Openly Investing Ltd.

10 March | Global Economy and COVID-19 Update #1

The first update from Openly Investing Ltd regarding the impact of COVID 19 on global economy